- Digital Media Products, Strategy and Innovation by Kevin Anderson

- Posts

- How BuzzFeed News failed to respond to Facebook's pivot away from news

How BuzzFeed News failed to respond to Facebook's pivot away from news

PLUS Scammers try to trick journalists into linking to their sites using AI generated copy

It's the Monday after BuzzFeed CEO Jonah Peretti announced that he was shutting down BuzzFeed News and focusing the group's news brand on the Huffington Post. What caught my attention was Peretti's widely leaked memo about the closure. In the mea culpa filled memo, he said that he had over-invested in BuzzFeed's news operation because he believed in their mission so strongly, and that led him to be slow to accept that the big social platforms would not support high-quality, free at the point of consumption journalism.

As I said in our newsletter at Pugpig, where I work, I don't think BuzzFeed's problems are industry-wide. BuzzFeed was, almost by design, a creature of Facebook, and its rise and fall track Facebook's alignment with journalism specifically and content outside of its platform more generally.

There a lot of lessons to be learned, and I'll leave you to read the piece. But one very important lesson is not to become strategically captive to another company. While Facebook's strategy aligned with sites like BuzzFeed, the site boomed. Peretti was far too slow to recognise that Zuck had turned his attention elsewhere. And for anyone who looked at site analytics, this pivot was clear.

And Digiday has a piece that digs deeper into the numbers of Facebook's shift more. I can say that in 2018, I heard that in 2017 traffic from Facebook to one group of news sites in the US dropped by 40%, and I remember in my days as an independent consultant than a national newspaper website I was working with that their referrals from Facebook dropped by 40% overnight after an algorithm change.

And the changes at BuzzFeed reached all the way to the top of the organisation with two C-level leaders leaving.

Publishers seeking new forms of revenue, and Google offering new options to app publishers

Digiday Research surveyed 112 publishing professionals on their subscription strategies, and while they found that large publishers were relying heavily on subs that smaller publishers are "less enthusiastic about subscriptions". What's interesting is to see the slight decline in publishers who got a large or very large part of their income from subs and a slight decline in the number of publishers who said that subs would be a major focus in the next six months. My sense is that many publishers have reached a subscription plateau in which they were having to exert greater effort to grow their subs revenue so are starting to look elsewhere for easier wins.

Under pressure from UK regulators, Google has proposed offering two new billing systems in its Google Play store that are outside of its payment systems. Billing data is incredibly valuable information. The next question will be whether this move goes far enough for the industry, but it's one more step in Google and Apple opening up the app economy.

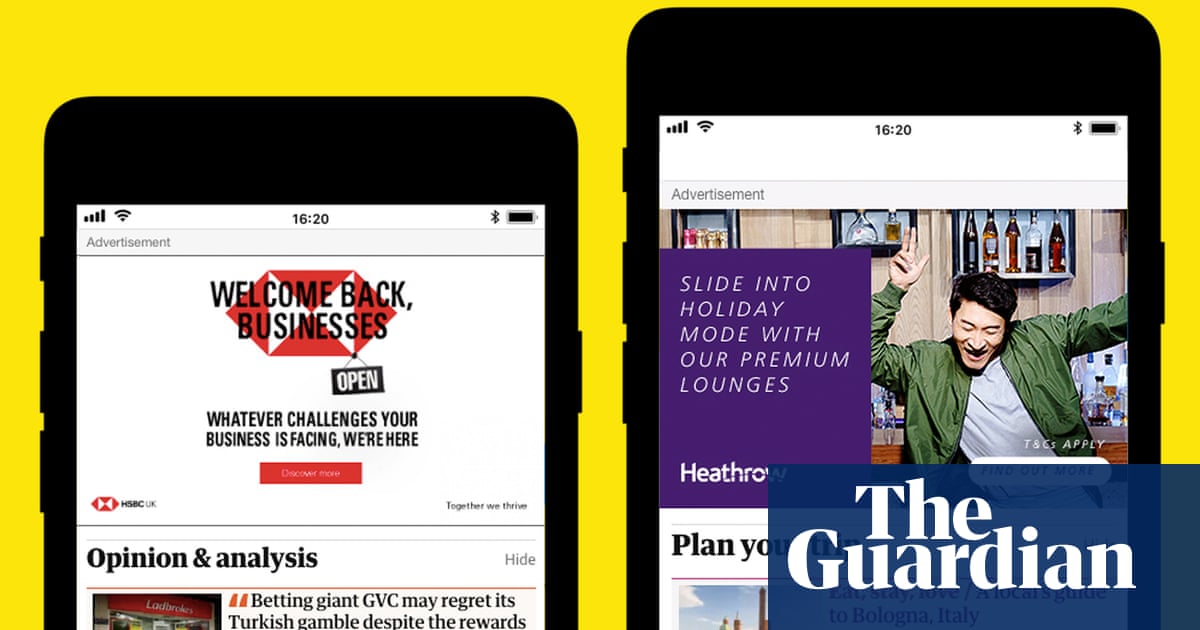

An interesting move by The Guardian to allow a company to categorise its pages for the purpose of contextual advertising. This could bea sign that its membership revenue model has plateaued.

I have heard from a few sources how hard publishers are working to land advertising deals and not delay payment. It is a sign of an industry facing significant uncertainty as advertisers delay their campaigns as they hope for greater business clarity.

This is a cautionary tale about how scammers looking for traffic to their low-quality sites are trying to use AI and social engineering to dupe journalists. I would be circulating this to any journalist working for me if I still worked in an editorial position.

After Twitter shut off API access to Flipboard this month, it's not surprising to see the news aggregator turn to Mastodon for curation. Flipboard even mentioned the decentralised social network after Twitter shut off its API. We'll see more and more of this as Twitter aggressively tries to ring-fence its network to drive its own profitability.